2016 ATTA CONFERENCE

Sydney, New South Wales

The 28th Annual ATTA Conference was hosted in Sydney, New South Wales by the University of New South Wales between 20 January and 22 January 2016.

Conference theme:

Tax & Time Travel

Please see below for images and past conference papers.

CONFERENCE PROGRAM

CONFERENCE PAPERS

Is the Citizen-Consumer the Future Taxpayer?

- BARRETT, Jonathan

Back to the Futuris: A Tale of Maladministration and Priviledge

- BEVACQUA, John

Tax and Superannuation Literacy: Australian and New Zealand Perspectives

- CHARDON, Toni et al

University Students and Tax Literacy: Opportunities and lessons for tax teaching

- CHARDON, Toni et al

- DABNER, Justin

Compensation: Does expenditure have to produce assessable income to be deductible?

- DELANY, Tom

- DEVOS, Ken

The Effectiveness of the National Tax Equivalent Regime (NTER) in Encouraging Competitive Neutrality

- DOUEIHI, Josephine

Taxing personal capital gains in Australia: An alternative way forward

- EVANS, Chris et al

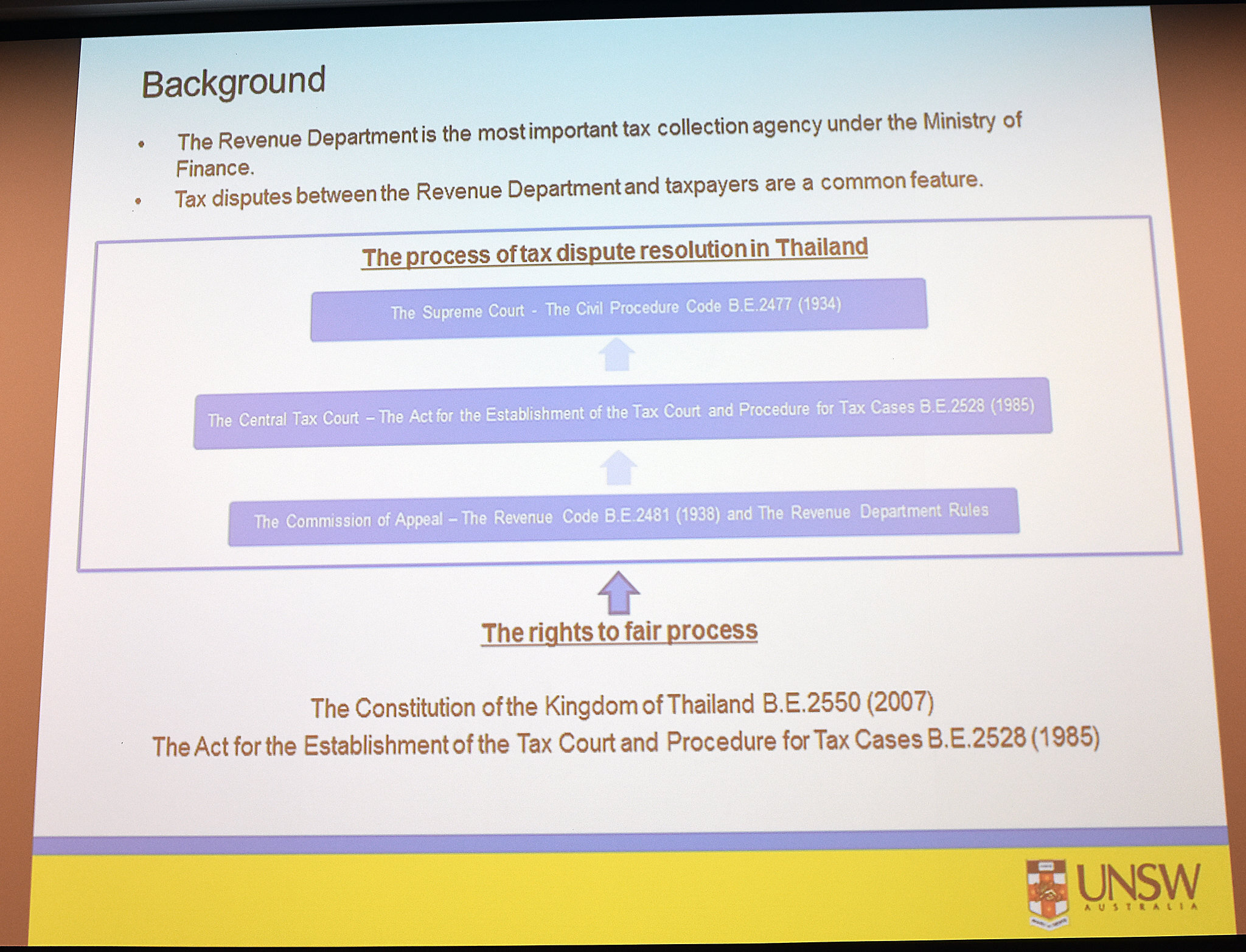

- FARIDY, Nahida et al

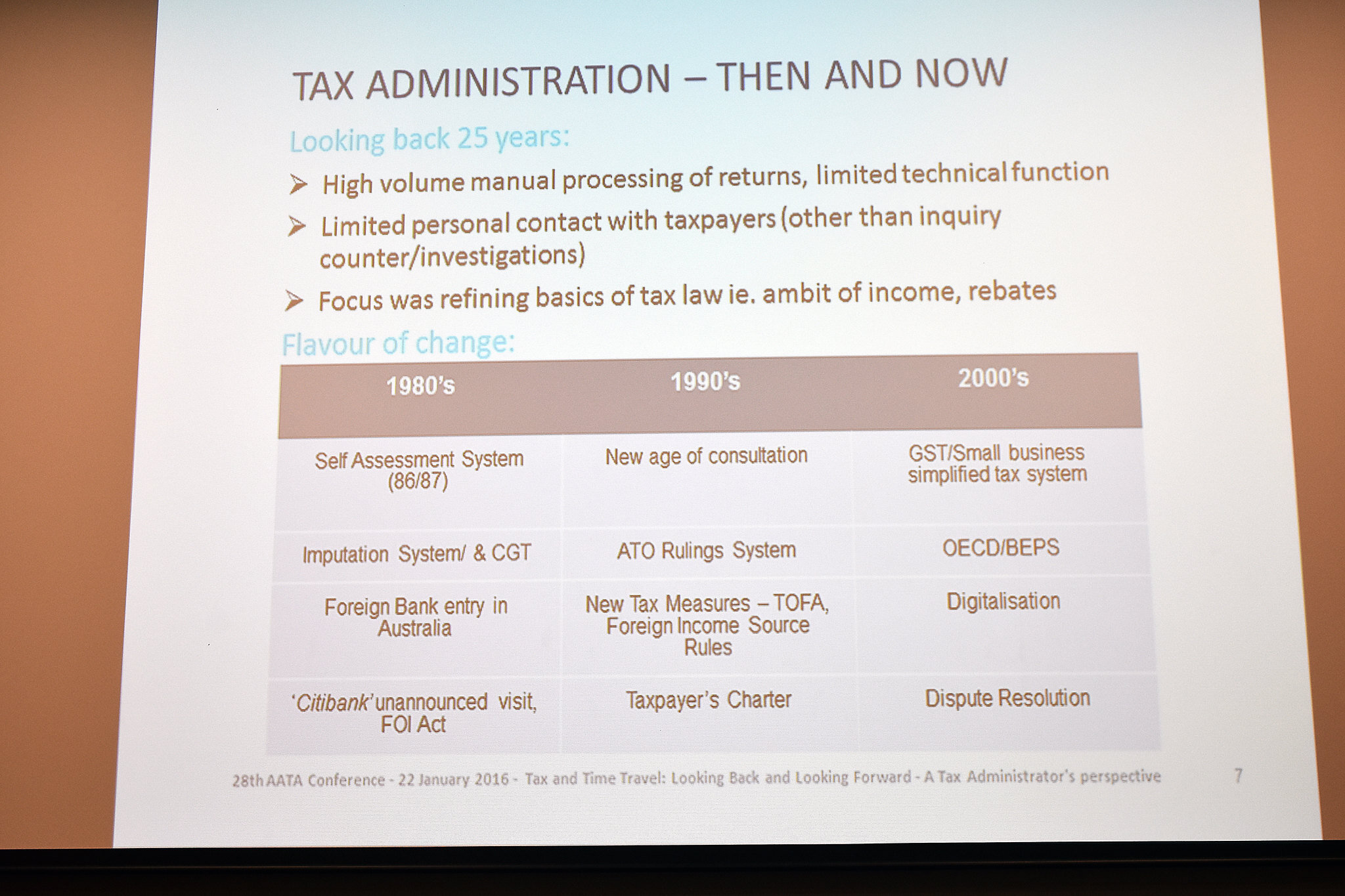

Tax and Time travel Looking Back and Looking Forward - a Tax Administrators perspective

- FARRELL, Jan

- FULLARTON, Alexander Robert

- GAIBL, Catherine and DICK, Caroline

Taxing Employee Share Schemes (ESS)

- GRAW, Stephen

- GUPTA, Ranjana

Gender Equality and a Rights Based Approach to Tax Reform

- HODGSON, Helen and SADIQ, Kerrie

Caught in a time warp - Mr JG Russell, The Great Tax Avoider of Old

- HODSON, Alistair

Evaluating New Zealand’s Tax Dispute Resolution System: A Dispute Systems Design Perspective

- JONE, Melinda

Taxing Sovereign Wealth Funds Mark II: Looking to Singapore for inspiration

- JOSEPH, Sally

A Multinational Multiverse: Simulating Tax-Optimal Intercompany Funding Structures

- KAYIS-KUMAR, Ann

- KHAN NIAZI, Shafi

Is There a Future for Environmental Taxes in New Zealand?

- MARRIOTT, Lisa

- MASSEY, David

- MORRISSEY, Suzy

A review of research into corporate tax aggressiveness and leverage puzzle

- NGUYEN, H. Khiem

The Empirical Study on the Effect of External Factors on Tax Auditors' Conciliatory Style

- NORDIN SYAHIRAH, Zarifah and MUHAMMAD, Izlawanie

The Tax Morale of the Individual Taxpayers in Indonesia by Demographic Factors

- PARLAUNGAN, Gorga

Tax and the forgotten classes - a potted history

- PASSANT, John

- PLEKHANOVA, Victoria

- ROSID, Arifin

- SALEHIFAR, Alireza

Australian Tax Reform: Public Policy Foundations and Challenges

- SMITH, Greg

Australian Tax Reform: Public Policy Foundations and Challenges (presentation slides)

- SMITH, Greg

Digital currency - may be a "bit player" now, but in the longer term a "game changer" for tax

- STERN, Steven

Entrepreneurship and Income Tax: What was the Past Like – and Travelling into the Future

- STEWART, Miranda and THOMAS, Steve

- TAN, Justin Jerzy

- TRAN-NAM, Binh et al

Comparing the Canadian and Australian GAARs

- TRETOLA, John

- TROTMAN, Thomas and KENDALL, Keith et al

Tax collection, recovery and enforcement issues for insolvent entities’

- VILLIOS, Sylvia

The Future of Inter-Governmental Cooperation on Value Added Tax Avoidance and Evasion

- WALPOLE, Michael

- WILSON-ROGERS

Challenging the validity of an assessment on the basis of conscious maladministration by the ATO

- WOELLNER, Robin

- YONG, Sue and MARTIN, Fiona